Weighing Your Options: Renting/Leasing vs. Owning Equipment and Vehicles in Commercial Facility Maintenance and Construction

Weighing Your Options: Renting/Leasing vs. Owning Equipment and Vehicles in Commercial Facility Maintenance and Construction

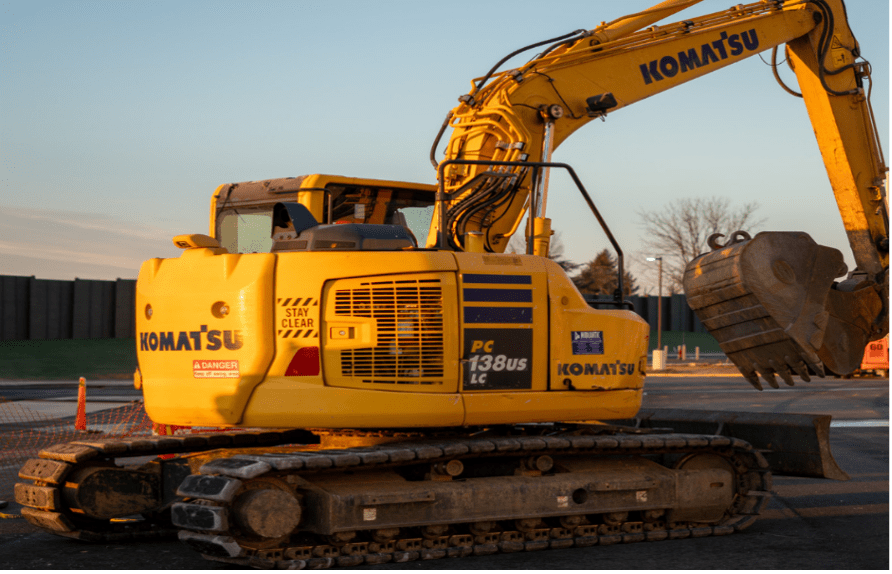

For commercial facility maintenance and construction providers, the decision between renting/leasing and owning equipment and vehicles is pivotal. Each option comes with its own set of pros and cons, influencing operational efficiency, financial flexibility, and business scalability.

Renting/Leasing Equipment and Vehicles

Pros:

- Reduced Initial Investment: Renting or leasing significantly lowers the initial capital requirement. This flexibility is particularly beneficial for startups or businesses facing cash flow constraints.

- Access to Latest Technology: Leasing agreements often include options to upgrade to newer models, ensuring access to the latest equipment without the expense of purchasing new.

- Maintenance and Repairs: Generally, the rental or leasing company is responsible for maintenance and repairs, reducing the burden on the service provider.

- Flexibility: Renting provides flexibility to scale equipment needs up or down based on seasonal demand or specific project requirements.

Cons:

- Higher Long-Term Cost: Over time, the total cost of renting or leasing can exceed the cost of owning, especially if the equipment is used frequently.

- Availability Issues: Depending on the rental company’s stock, the desired equipment may not always be available when needed.

- Lack of Equity: Renting or leasing doesn’t contribute to building equity in the business, as there’s no asset ownership.

Owning Equipment and Vehicles

Pros:

- Asset Ownership: Owning equipment contributes to the business's assets, which can be beneficial for credit purposes and increases the company’s net worth.

- Long-Term Cost-Effectiveness: While the initial investment is higher, owning can be more cost-effective in the long run, especially for equipment that's used regularly.

- Depreciation Benefits: Owners can benefit from tax deductions through depreciation.

- Full Control and Availability: Owning equipment ensures its availability whenever needed and allows for complete control over its use and maintenance.

Cons:

- Upfront Capital Requirement: Purchasing equipment requires a significant initial investment, which can be a barrier for smaller or newer companies.Purchasing equipment requires a significant initial investment, which can be a barrier for smaller or newer companies.Purchasing equipment requires a significant initial investment, which can be a barrier for smaller or newer companies.Purchasing equipment requires a significant initial investment, which can be a barrier for smaller or newer companies.Purchasing equipment requires a significant initial investment, which can be a barrier for smaller or newer companies.

- Maintenance and Repair Costs: All maintenance, repair, and operational costs fall on the owner, which can be significant over time.

- Obsolescence Risk: Owners bear the risk of their equipment becoming outdated, particularly in a rapidly evolving tech landscape.

- Resale and Storage Issues: Owners need to manage the resale or disposal of old equipment and also need adequate storage for their fleet.

The choice between renting/leasing and owning is contingent on various factors like the frequency of equipment use, financial capacity, business size, and long-term business strategy. Service Providers should consider their specific circumstances and business goals when making this decision. A balanced approach, where critical equipment is owned and specialized or less frequently used equipment is rented, might be the most cost-effective strategy for many businesses.

For a more in-depth analysis and personalized advice, service providers should consult with financial advisors and consider current market trends and future business projections. This strategic decision is not just a financial one; it's about aligning equipment management with the overall business plan.